How to Combine Chart Patterns with Volume Analysis

Volume confirms chart pattern validity by revealing conviction behind price moves. Research shows patterns with proper volume confirmation tend to achieve better post-breakout performance. The key principle: volume should contract during pattern formation and expand on breakout.

Note: Thomas Bulkowski's extensive research demonstrates that breakouts accompanied by above-average volume consistently show better post-breakout performance across pattern types.

The Missing Piece in Pattern Trading

Two traders spot the same ascending triangle on ETH/USDT. One enters on the breakout and profits. The other enters on the same breakout and gets stopped out on a false move. Same pattern. Same pair. Different outcomes.

The difference? Volume.

Most traders learn to identify patterns but never learn to read what volume tells them about those patterns. They're reading half the story. This guide shows you exactly how volume behaves during pattern formation and breakout for 8 major chart patterns.

What You'll Learn:

- Why volume contracts during formation

- Bullish and bearish volume signatures

- How to spot divergence warnings

- Crypto-specific volume thresholds

The Foundation - Why Volume Confirms Patterns

Price Shows What Happened. Volume Shows How Real It Is.

Volume represents conviction. When price moves on high volume, many participants agree with that direction. When price moves on low volume, few participants are involved - making the move suspect.

“Volume should expand in the direction of the trend.”

- Charles Dow, foundational principle of market analysisThe Volume-Price Matrix

| Price Movement | Volume | Interpretation |

|---|---|---|

| Price Up | Volume Up | Bullish - buyers stepping in |

| Price Up | Volume Down | Warning - weak conviction |

| Price Down | Volume Up | Bearish - sellers in control |

| Price Down | Volume Down | Warning - selling exhausted |

Source: Adapted from John Murphy's "Technical Analysis of the Financial Markets"

Why This Matters for Patterns

Chart patterns are consolidation zones where buyers and sellers battle. Volume tells you who's winning that battle - and when one side is about to give up.

The Universal Rule - Contraction and Expansion

Volume Contracts During Formation, Expands on Breakout

Nearly all chart patterns share one volume characteristic: volume decreases as the pattern develops, then surges when price breaks out.

During Formation:

- Uncertainty increases as pattern develops

- Traders wait on sidelines for resolution

- Lower participation = lower volume

- This "coiling" effect stores energy

At Breakout:

- Uncertainty resolves

- Sidelined traders enter

- Stops trigger on trapped traders

- Participation surges = volume surge

The Confirmation Rule

Thomas Bulkowski's research found that breakouts with above-average volume showed better follow-through. A reasonable threshold: breakout volume should exceed the 20-day average by at least 25-30% for traditional markets.

Bullish Patterns + Volume Signatures

Ascending Triangle

Flat resistance + rising support. Bullish continuation.

| Phase | Expected Volume |

|---|---|

| During formation | Declining (each test of resistance shows less volume) |

| Breakout above resistance | Sharp expansion (above-average volume) |

| Pullback to breakout level | Lower than breakout volume |

“The volume trend is downward, too, until the upward breakout.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 740)Key Insight: Volume should decline on each successive test of resistance. If volume INCREASES on the third or fourth test, buyers are getting more aggressive - breakout is likely imminent.

Ascending triangle with declining volume during formation and expansion on breakout — NEO/USDT (1min, Bybit) detected by ChartScout

Double Bottom

Two lows at similar price level. Bullish reversal.

| Phase | Expected Volume |

|---|---|

| First bottom | High (selling climax) |

| Second bottom | LOWER than first bottom |

| Breakout above neckline | Expansion confirms |

“The left bottom usually shows higher volume.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 239)Key Insight: The second bottom MUST have lower volume than the first. This shows selling pressure is exhausted - fewer sellers remain. Performance improves for patterns with a declining volume trend and volume heavier on the left bottom.

Double bottom with volume divergence - higher volume on first bottom, lower on second — ZEN/USDT (5min, Bybit) detected by ChartScout

Key Indicator: Bullish Divergence

Price makes equal lows, but volume makes a LOWER low. This shows selling pressure is exhausted - fewer sellers remain. If second bottom has HIGHER volume than first, pattern may fail.

Bull Flag

Sharp move up (pole) + tight consolidation (flag). Continuation pattern.

| Phase | Expected Volume |

|---|---|

| Flagpole (initial surge) | Very high (impulse move) |

| Flag (consolidation) | Very low (should dry up) |

| Breakout from flag | Expansion (not as high as pole) |

“The volume trend nearly always recedes over the course of the formation.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 357)Key Insight: Flag volume should be less than 50% of flagpole average volume. If volume stays high during the flag, it's likely distribution - not consolidation.

Bull flag showing high volume on pole, declining volume during flag formation — ZEC/USDT (15min, Binance) detected by ChartScout

Falling Wedge

Converging trendlines sloping downward. Bullish reversal pattern.

| Phase | Expected Volume |

|---|---|

| During formation | Declining steadily |

| Breakout above upper trendline | Moderate expansion (1.5-2x) |

“Volume trend. The volume trend should be downward...7 out of every 10 formations show a downward volume pattern.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 821)Key Insight: Volume decline during a falling wedge shows selling pressure is weakening. Each push lower happens on less conviction. Wedge breakouts can occur on lighter volume than triangles - 70% of formations display this downward volume pattern.

Falling wedge with declining volume during formation - bullish reversal setup — BTC/USDT (3min, KuCoin) detected by ChartScout

Triple Bottom

Three lows at similar price level. Stronger bullish reversal than double bottom.

| Phase | Expected Volume |

|---|---|

| First bottom | Highest (selling climax) |

| Second bottom | Lower than first |

| Third bottom | Lowest of the three |

| Breakout above neckline | Strong expansion |

“Each of the three bottoms usually shows volume that peaks above the days leading to the bottom, with the first bottom usually having the highest volume of the trio.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 790)Warning Sign: If volume INCREASES on the third bottom compared to the second, sellers may be returning - pattern reliability decreases. The overall volume trend should be downward.

Triple bottom with declining volume on each successive bottom - bullish reversal — BTC/USDT (15min, Binance) backtested by ChartScout

Bull Pennant

Sharp move up (pole) + small symmetrical triangle (pennant). Continuation pattern.

| Phase | Expected Volume |

|---|---|

| Flagpole (initial surge) | Very high (impulse move) |

| Pennant (consolidation) | Downward trending - should dry up |

| Breakout from pennant | Expansion confirms continuation |

“Most of the time, pennants will have a downward volume trend.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 545)Pennant vs Flag: Pennants typically resolve faster than flags - expect 1-3 weeks duration. Volume contraction should be more pronounced and rapid. Heavy breakout volume propels prices farther.

Bull pennant showing high volume pole vs contracted pennant volume — PIPPIN/USDT (15min, MEXC) detected by ChartScout

Symmetrical Triangle

Converging trendlines with no directional bias. Can break either direction but slightly favors continuation.

| Phase | Expected Volume |

|---|---|

| During formation | Declining steadily (critical) |

| Breakout (either direction) | Strong surge required |

“Volume trend splits between those triangles with breakouts in the direction of the prevailing trend and the countertrend triangles.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 782)Warning Sign: A breakout on weak volume frequently fails. Symmetrical triangles are notorious for false breakouts - volume confirmation is essential. Volume behavior depends on breakout direction relative to the prior trend, but declining volume during formation remains consistent.

Symmetrical triangle with declining volume during formation and expansion on breakout — ETH/USDT (3min, Binance) detected by ChartScout

Channel Up (Ascending Channel)

Price moves between two parallel upward-sloping trendlines. Bullish trend continuation.

| Phase | Expected Volume |

|---|---|

| Rallies to upper trendline | Higher volume |

| Pullbacks to lower trendline | Lower volume |

| Breakout above upper channel | Strong expansion |

Warning Sign: If volume starts expanding on pullbacks toward the lower trendline, the channel may be weakening - potential breakdown ahead.

Ascending channel with higher volume on rallies to upper trendline — ETH/USDT (1min, KuCoin) detected by ChartScout

Bearish Patterns + Volume Signatures

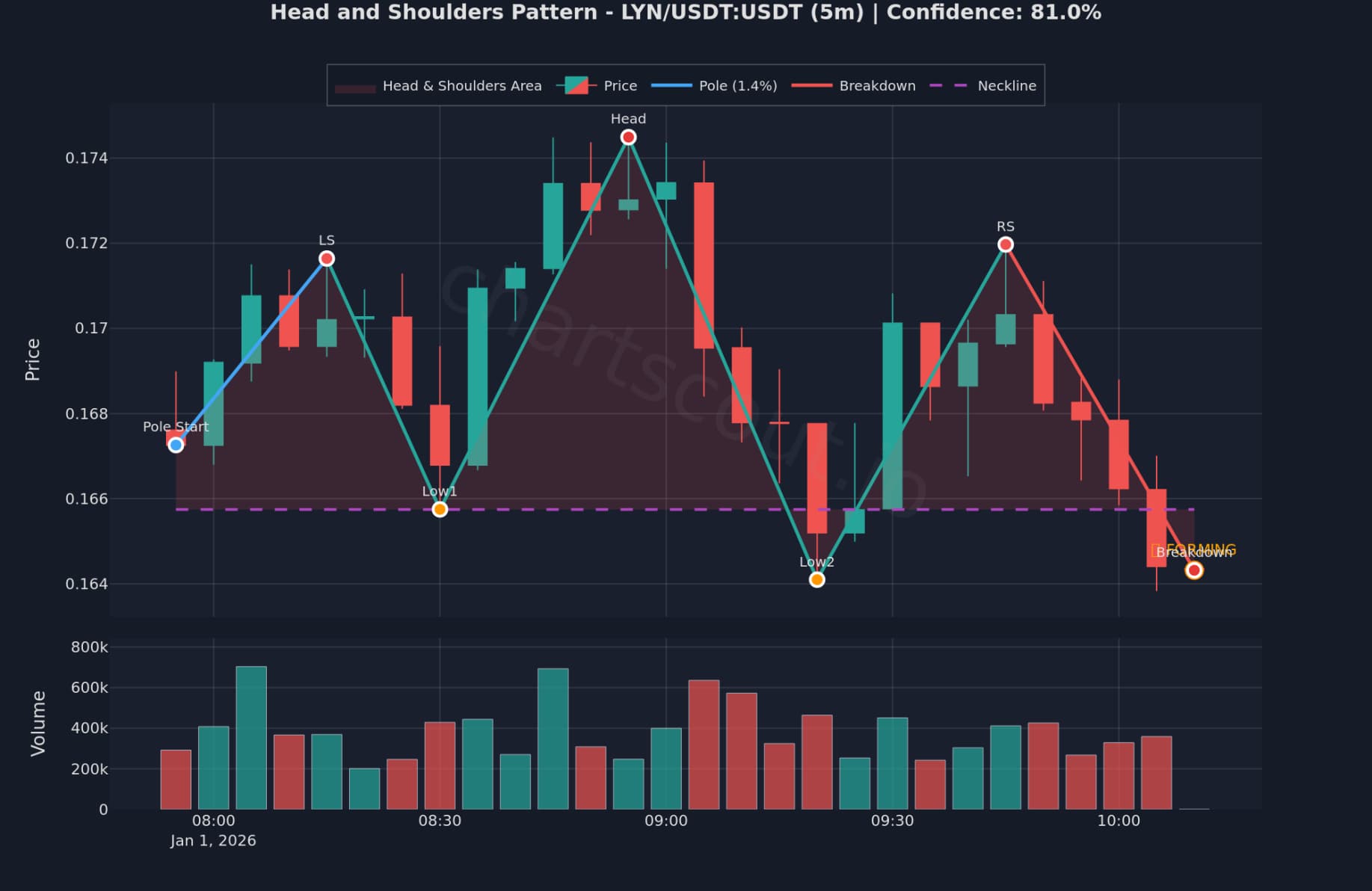

Head and Shoulders

Three peaks - middle (head) higher than two shoulders. Bearish reversal.

| Phase | Expected Volume |

|---|---|

| Left shoulder | Highest |

| Head | Lower than left shoulder |

| Right shoulder | Lowest of the three |

| Neckline break | Expansion confirms breakdown |

“The real tip-off that an H&S pattern is developing comes with the formation of the right shoulder, which is invariably accompanied by distinctly lower volume than the head or the left shoulder.”

- Martin Pring, Pring on Price Patterns

Head and shoulders pattern with declining volume across the three peaks — LYN/USDT (5min, Binance) detected by ChartScout

Descending Triangle

Flat support + declining resistance. Bearish continuation.

| Phase | Expected Volume |

|---|---|

| During formation | Declining |

| Breakdown below support | Expansion confirms |

“Volume trend: Receding.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 758)Key Insight: Mirror image of ascending triangle - volume should decline on each successive test of support. If volume INCREASES on later tests, sellers are getting more aggressive.

Descending triangle with declining volume during formation and expansion on breakdown — BTC/USDT (1min, KuCoin) detected by ChartScout

Rising Wedge

Converging trendlines sloping upward. Bearish reversal pattern.

| Phase | Expected Volume |

|---|---|

| During formation | Declining steadily |

| Breakdown below lower trendline | Moderate expansion (1.5-2x) |

“The receding volume pattern is another key element in correctly identifying a rising wedge.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 837)Key Insight: Rising wedges are deceptive because price is moving up, but declining volume reveals weakening buying pressure. The pattern shows buyers losing conviction with each new high.

Rising wedge with declining volume despite rising price - bearish divergence

Bear Flag

Sharp move down (pole) + tight upward consolidation (flag). Bearish continuation.

| Phase | Expected Volume |

|---|---|

| Flagpole (initial drop) | Very high (panic selling) |

| Flag (consolidation) | Very low (should dry up) |

| Breakdown from flag | Expansion (can be lighter than pole) |

“The volume trend nearly always recedes over the course of the formation.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 357)Key Insight: Low volume during the flag shows the bounce is just short-covering, not genuine buying interest. If volume stays high during the flag, buyers may be stepping in - be cautious.

Bear flag showing high volume on downward pole, declining volume during flag consolidation — FWOG/USDT (5min, Bybit) detected by ChartScout

Double Top

Two highs at similar price level. Bearish reversal.

| Phase | Expected Volume |

|---|---|

| First top | High (buying climax) |

| Second top | LOWER than first top |

| Breakdown below neckline | Expansion confirms |

“Top volume. Volume is usually higher on the left peak than on the right.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 280)Warning Sign: If second top has HIGHER volume than first, buyers are still aggressive - pattern may fail or evolve into continuation. Performance improves with declining volume trend.

Double top with volume divergence - higher volume on first top, lower on second — ZEC/USDT (15min, Binance) detected by ChartScout

Key Indicator: Bearish Divergence

Price makes equal highs, but volume makes a LOWER high. This shows buying pressure is exhausted - fewer buyers remain at resistance. This divergence is your early warning before breakdown.

Triple Top

Three highs at similar price level. Stronger bearish reversal than double top.

| Phase | Expected Volume |

|---|---|

| First top | Highest (buying climax) |

| Second top | Lower than first |

| Third top | Lowest of the three |

| Breakdown below neckline | Strong expansion |

“Volume trend: Downward.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 801)Warning Sign: If volume INCREASES on the third top compared to the second, buyers may be returning - pattern reliability decreases significantly. The overall volume trend should be downward.

Triple top with declining volume on each successive top - bearish reversal — ETH/USDT (1h, Binance) backtested by ChartScout

Bear Pennant

Sharp move down (pole) + small symmetrical triangle (pennant). Bearish continuation.

| Phase | Expected Volume |

|---|---|

| Flagpole (initial drop) | Very high (panic selling) |

| Pennant (consolidation) | Downward trending - should dry up |

| Breakdown from pennant | Expansion confirms continuation |

“Most of the time, pennants will have a downward volume trend.”

- Thomas Bulkowski, Encyclopedia of Chart Patterns (p. 545)Pennant vs Flag: Bear pennants typically resolve faster than bear flags - expect 1-3 weeks duration. The symmetrical consolidation shows balanced short-term uncertainty before sellers regain control. Heavy breakdown volume propels prices farther.

Bear pennant showing high volume pole vs contracted pennant volume — ETH/USDT (15min, Binance) backtested by ChartScout

Channel Down (Descending Channel)

Price moves between two parallel downward-sloping trendlines. Bearish trend continuation.

| Phase | Expected Volume |

|---|---|

| Declines to lower trendline | Higher volume |

| Rallies to upper trendline | Lower volume |

| Breakdown below lower channel | Strong expansion |

Warning Sign: If volume starts expanding on rallies toward the upper trendline, the channel may be weakening - potential reversal ahead.

Descending channel with higher volume on declines to lower trendline — BTC/USDT (15min, MEXC) detected by ChartScout

Volume Divergence - The Early Warning System

Volume divergence occurs when price and volume move in opposite directions. This disconnect often signals an impending reversal before price confirms it.

Bullish Divergence

Price makes lower lows, but volume makes higher lows.

- Selling pressure is exhausting

- Fewer sellers at each new low

- Watch for reversal patterns forming

Bearish Divergence

Price makes higher highs, but volume makes lower highs.

- Buying pressure is weakening

- Fewer buyers at each new high

- Watch for distribution patterns

Using Divergence with Patterns

Divergence is most powerful when it appears at pattern boundaries. For example, a double bottom with bullish volume divergence (second bottom on lower volume) has significantly higher success probability than one without.

Climax Volume - Exhaustion Signals

Climax volume represents extreme participation - typically 5x or more above average. It often marks the end of a trend as the last buyers or sellers exhaust themselves.

| Climax Type | Characteristics | What It Signals |

|---|---|---|

| Selling Climax | Huge volume spike on sharp price drop | Panic selling exhausted - potential bottom |

| Buying Climax | Huge volume spike on sharp price rise | FOMO buying exhausted - potential top |

Critical Context

Climax volume alone is not a trade signal. Wait for a pattern to form after the climax. A selling climax followed by a double bottom pattern with volume divergence is a high-probability setup. The climax exhausts one side; the pattern confirms the reversal.

“The climax marks the point where supply overwhelms demand (or vice versa). After the climax, the market needs time to absorb the excess before a new trend can begin.”

- Richard Wyckoff, foundational principle of volume analysisCrypto-Specific Adjustments

Due to higher volatility and 24/7 nature, crypto markets often exhibit more extreme volume characteristics than traditional markets. The following thresholds are practical guidelines based on observed crypto market behavior:

| Confirmation Level | Volume vs 20-period Average |

|---|---|

| Moderate | ~2x average* |

| Strong | ~3x average* |

| Climax | 5x+ average* |

*Practical thresholds based on observed crypto market behavior. Adjust based on the specific asset's typical volatility.

Three Golden Rules for Crypto Volume:

- 1

Relative Comparison: Compare volume to the same hour on previous days, not just the daily average, to account for intraday liquidity cycles.

- 2

Aggregate View: Volume is scattered across exchanges. Use ChartScout to get an aggregated view across Binance, Bybit, KuCoin, and MEXC.

- 3

Trend Over Value: Focus on relative changes (spikes) rather than absolute numbers to filter out wash trading effects.

Practical Checklist

Green Flags (A+ Setup)

- ✓Volume declining during formation

- ✓Clear volume divergence at peaks/troughs

- ✓Breakout volume 2-3x average

- ✓Pullback happens on significantly lower volume

Red Flags (Consider Passing)

- ✕Breakout on below-average volume

- ✕Pattern forms with INCREASING volume

- ✕Pullback has HIGHER volume than breakout

- ✕No divergence at reversal boundaries

Frequently Asked Questions

How much volume increase confirms a breakout?

For traditional markets, Bulkowski's research suggests breakouts with above-average volume show better follow-through. For crypto markets, due to higher volatility, many traders look for approximately 2x the average for moderate confirmation, though optimal thresholds vary by asset.

Does volume matter more for upside or downside breakouts?

Volume confirmation is more critical for upside breakouts. Buying requires active participation. Prices can fall on lighter volume simply from lack of buying support, but active buying pressure is needed to push prices higher.

What if the pattern looks perfect but volume doesn't confirm?

Pass or reduce size. A technically perfect pattern without volume confirmation has significantly higher failure rate. Volume tells you whether the market agrees with what the pattern suggests.

Should I use On-Balance Volume (OBV) with chart patterns?

OBV can complement pattern analysis by showing cumulative buying/selling pressure. Look for OBV to confirm the breakout direction - if price breaks up but OBV is trending down, the breakout may fail. However, raw volume spikes at breakout remain the primary confirmation signal.

Stop Watching Charts Manually

ChartScout monitors 8 bullish and bearish patterns across 1,000+ crypto pairs on Binance, Bybit, KuCoin, and MEXC - detecting formations with proper volume signatures in real-time.

No credit card required. Alerts delivered in under 20 seconds.

Sources & References

Academic & Technical Analysis Literature

Primary sources for pattern and volume analysis principles:

- Bulkowski, Thomas N. Encyclopedia of Chart Patterns, 2nd Edition. Wiley, 2005. ISBN: 978-0471668268.

Chapters 24-27 (Triangles), 35 (Double Bottoms), 37 (Double Tops), 48 (Flags), 54 (Pennants), 63 (Triple Bottoms), 64 (Triple Tops), 66 (Wedges). Volume analysis based on statistical research across thousands of patterns. - Pring, Martin J. Pring on Price Patterns: The Definitive Guide to Price Pattern Analysis and Interpretation. McGraw-Hill, 2005. ISBN: 978-0071440387.

Chapter 7: Head & Shoulders volume characteristics and confirmation signals. - Murphy, John J. Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications. New York Institute of Finance, 1999. ISBN: 978-0735200661.

Chapters 7-8: Volume analysis principles and price-volume relationships. - Wyckoff, Richard D. Original works and market studies, 1910-1931.

Selling Climax (SC) and Buying Climax (BC) concepts, accumulation/distribution phase analysis. - Dow, Charles H. Wall Street Journal editorials, 1899-1902.

Foundational principle: “Volume should expand in the direction of the trend.”

Crypto Market Research

Industry research on cryptocurrency volume dynamics:

- Chainalysis. Crypto Market Manipulation 2025: Suspected Wash Trading, Pump and Dump Schemes. February 2025.

Key finding: $2.57 billion in suspected wash trading on DEXs in 2024, with 4.52% of launched tokens displaying wash trading patterns. Most manipulation concentrated among a small number of sophisticated actors. - Advances in Consumer Research (ACR Journal). The Weekend Effect in Crypto Momentum: Does Momentum Change When Markets Never Sleep? September 2025.

Key finding: Weekend trading volume is 20-25% lower than weekdays, creating thinner markets where momentum-driven trades exert greater price impact. - CCData (CoinDesk Data). Exchange Review. March 2023.

Key finding: Derivatives market represents 72.7% of total crypto market volume - an all-time high. Spot-driven markets tend to be more resistant to short-term volatility.